28+ write off mortgage interest

Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025. Ad Developed by Lawyers.

28 Rate Sheet Templates Word Excel Pdf Document Download

State and local taxes have long been one of the largest write-offs for those who itemize.

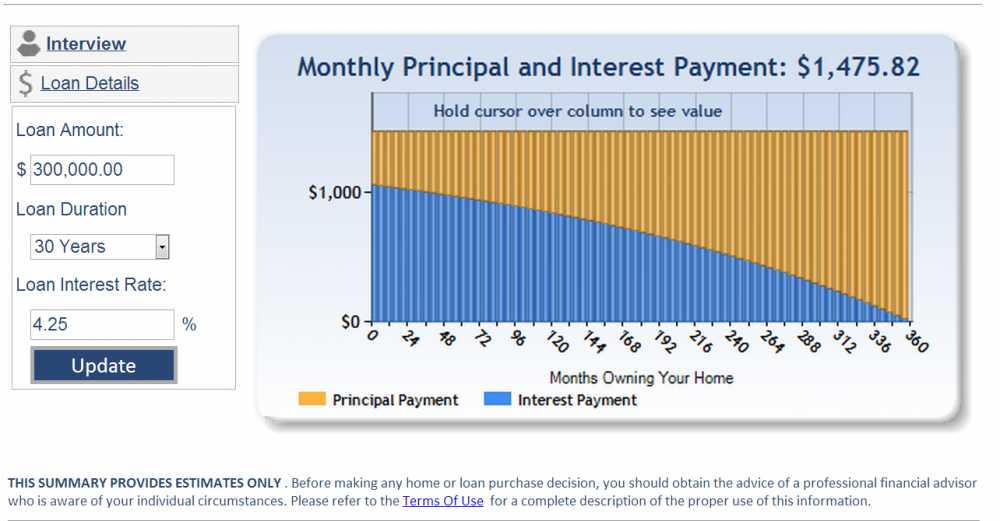

. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. Web March 4 2022 439 pm ET. In addition to itemizing these conditions must be met for mortgage interest to be deductible.

Web If the loan proceeds say from a refinance are used to pay off credit card debt buy new clothes or take a trip to the Bahamas the interest may qualify as home. In this case as a couple. Web You cant deduct the principal the borrowed money youre paying back.

Web If your annual mortgage interest paid for the home was 12000 you could deduct 4000 as an expense 12000 x 333 4000. Web If youve closed on a mortgage on or after Jan. Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household.

Web The tax benefit for mortgage interest deductions will be 750000 for this years tax year which means a home buyer will be able to deduct the interest paid on up. However higher limitations 1 million 500000 if married. Web As of the beginning of 2018 couples who file their taxes jointly are only able to deduct interest on up to 750000 of eligible mortgages which is down from 1 million.

Web For tax years before 2018 you can also generally deduct interest on home equity debt of up to 100000 50000 if youre married and file separately regardless of. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web Most homeowners can deduct all of their mortgage interest.

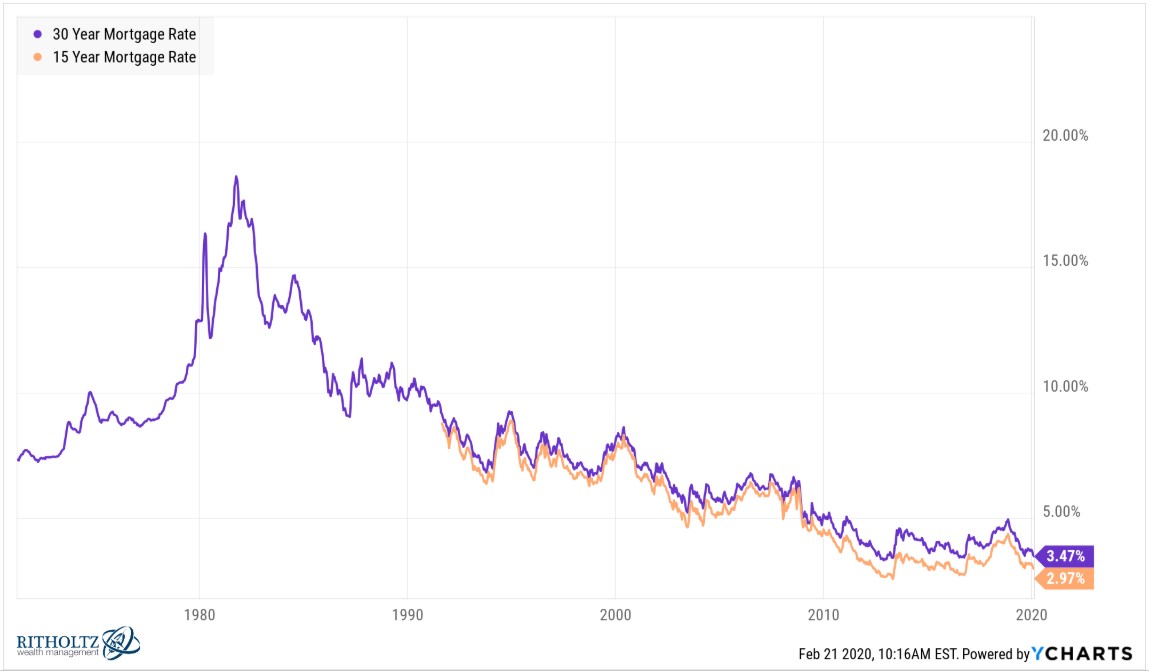

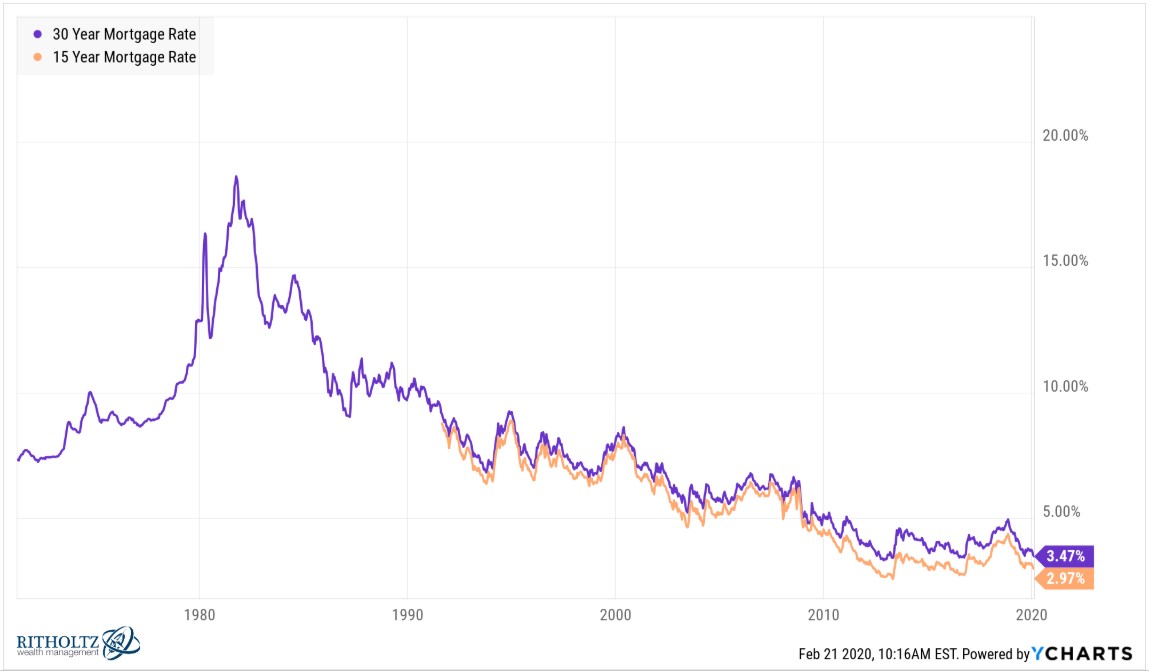

In March 2021 the average two-year fixed rate was 257 per cent and the five-year average rate was 275. Web Mortgage interest. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage.

Create Your Satisfaction of Mortgage. Web The short answer is. 1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for.

It all depends on how the property is used. LawDepot Has You Covered with a Wide Variety of Legal Documents. 8 2022 at 144 pm.

2000 Your total itemized deductions come out to 14500. 2 minutes The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply. 12 Tax Deductions That Have Disappeared.

Married filing jointly or qualifying widow. Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098. Ad Chat Online Right Now with a Tax Expert and Get Info About Tax-Deductible Donations.

Ask a Tax Expert for Info Now About How to Write-Off Mortgage Interest in a Private Chat. Web For 2021 tax returns the government has raised the standard deduction to. Web Halifax has a deal at 399 per cent for the same term.

How Much Interest Can You Save By Increasing Your Mortgage Payment. Web The write-off is limited to interest on up to 750000 375000 for married-filing-separately taxpayers of mortgage debt incurred after Dec. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

Single or married filing separately 12550. You may still be able to. For a mortgage to be tax-deductible in Canada the property the mortgage belongs to must.

28 Best Marketing Powerpoint Ppt Templates In 2023

Should I Pay Off My Mortgage Early Saverocity Finance

What Your Mortgage Interest Rate Really Means Money Under 30

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Use These Charts To Quickly See How Much The Higher Mortgage Rates Will Cost You

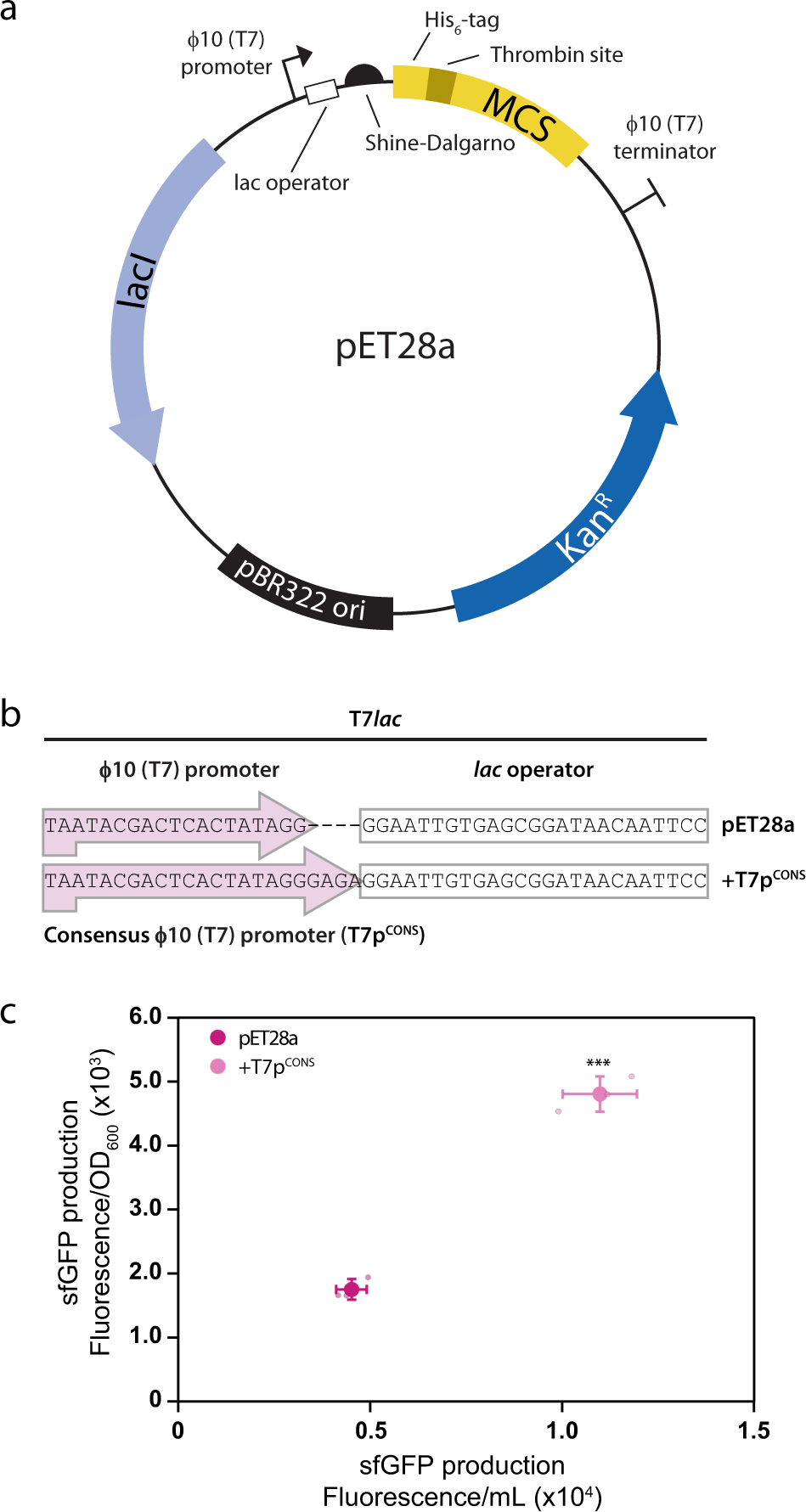

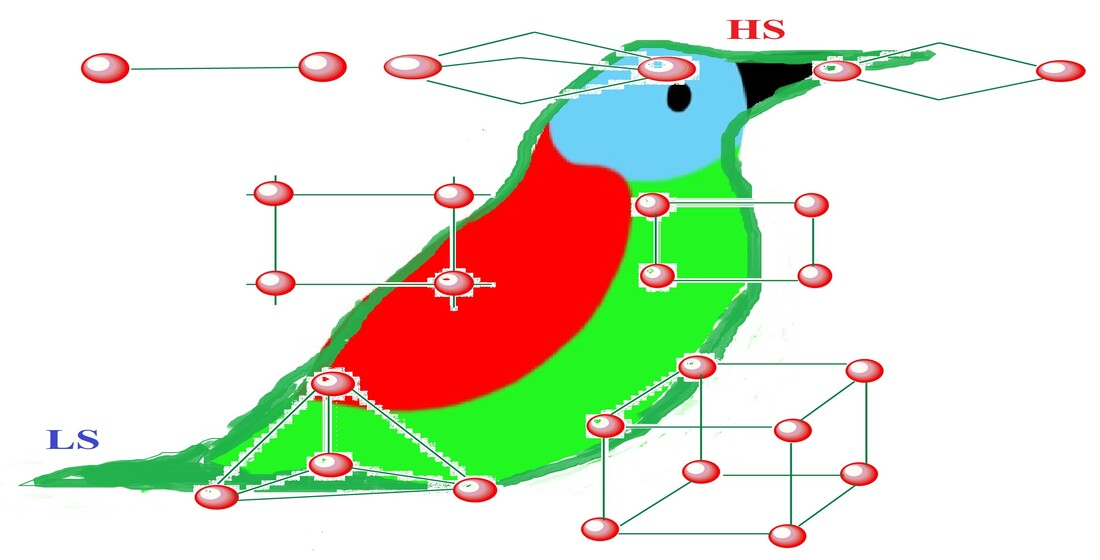

Improved Designs For Pet Expression Plasmids Increase Protein Production Yield In Escherichia Coli Communications Biology

Is Mortgage Interest Still Deductible After Tax Reform

Mortgage Interest Tax Deduction What You Need To Know

Great Lakes Bay Listings Real Estate Magazine 10 28 By Midland Daily News Issuu

28 Ac Johnstown Rd Chesapeake Va 23322 Mls 10421385 Redfin

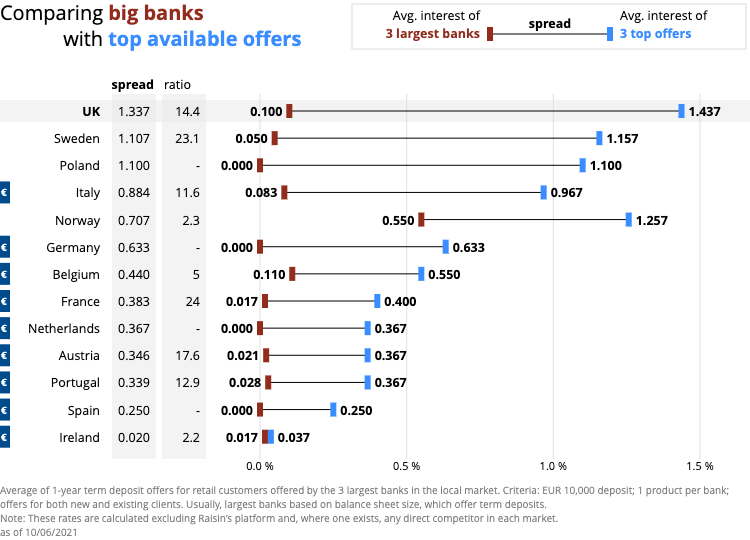

Interest Rates Explained By Raisin

Break Free From Your Mortgage The Secret Banking Strategy To Help You Pay Off Your Mortgage Fast Kwak Sam Bruce David 9781087973623 Amazon Com Books

The Home Mortgage Interest Deduction Lendingtree

Should You Pay Off Your Mortgage Early With Rates So Low

Enantioselective Photochemical Reactions Enabled By Triplet Energy Transfer Chemical Reviews

Business Enquirer Issue 107 Sustainability Leaders September 2022 By Business Enquirer Internal Use Only Not Downloadable Issuu

Molecules Free Full Text Iron Ii Mediated Supramolecular Architectures With Schiff Bases And Their Spin Crossover Properties