Profit level indicator transfer pricing

Reliability of Return on Assets as a Profit Indicator. Profit level indicators that may provide a reliable basis for comparing operating profits of the tested party and uncontrolled comparables include the following-- i Rate of.

The Transactional Net Margin Method Explained With Example

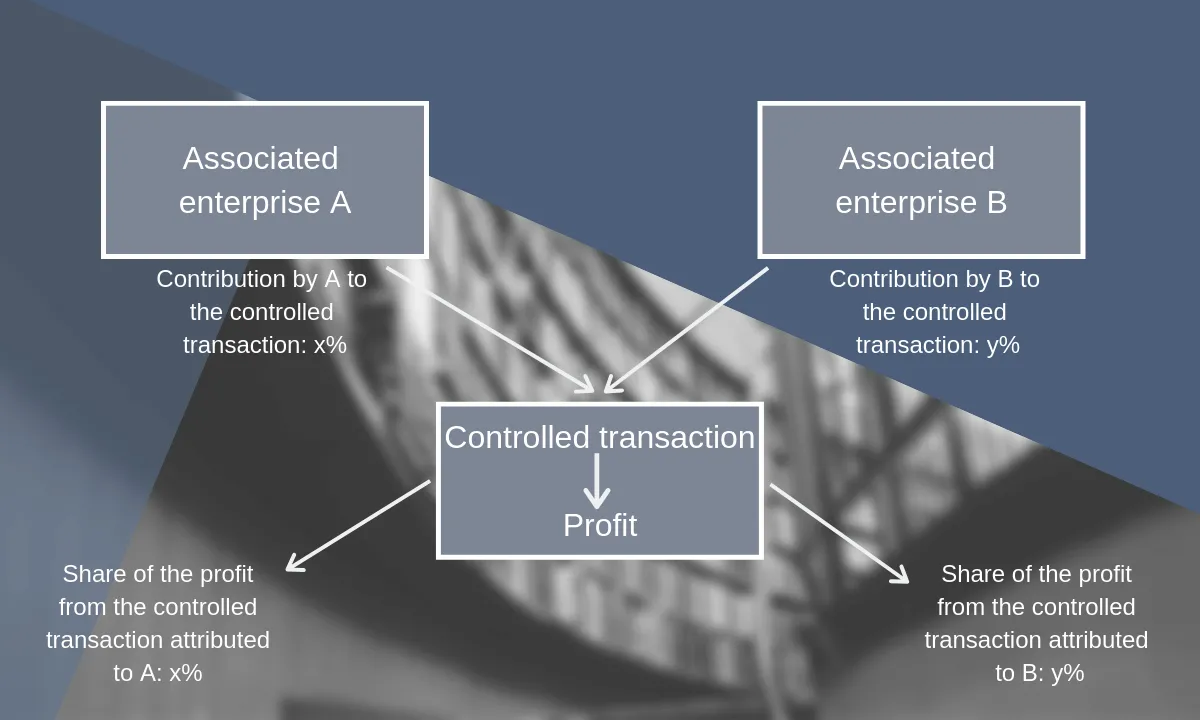

Profit split or transactional net margin methodApplying all the aforementioned transfer pricing methods except the comparable uncontrolled price method the arms length.

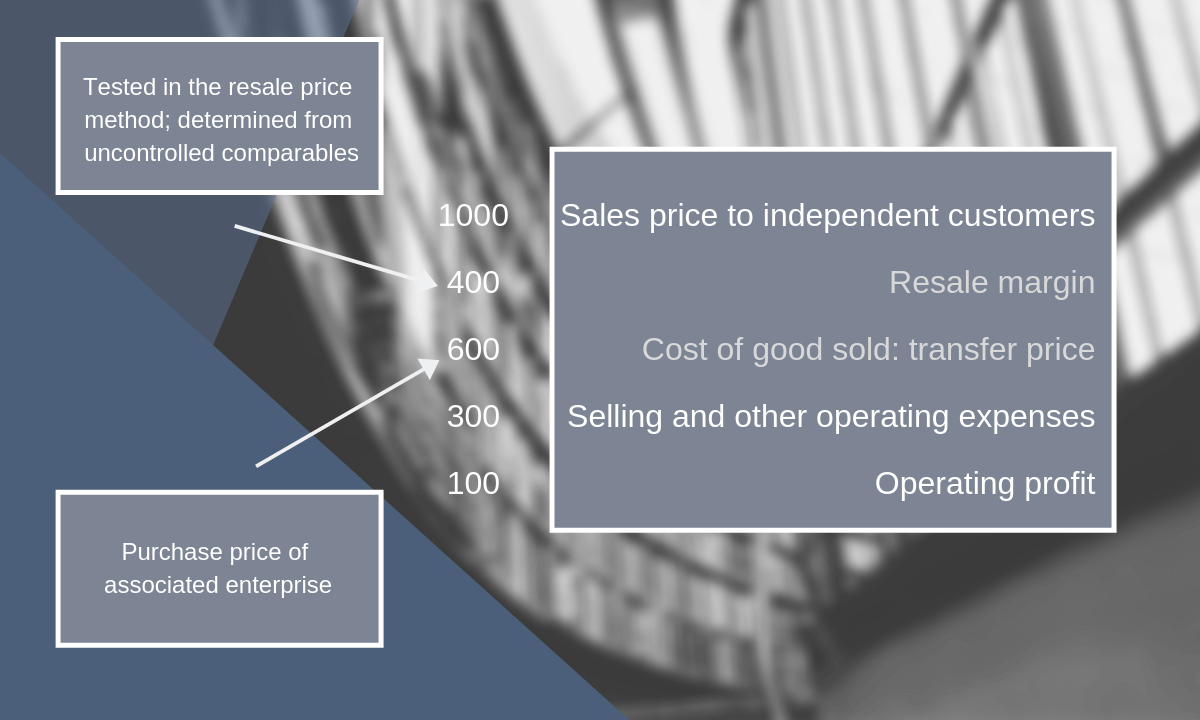

. A profit level indicator PLI is a measure of a companys profitability that is used to compare comparables companies profit level with the company having international. Posted on 3 Feb 2017 2 Apr 2017. In transfer pricing the main problem for practitioners is to choose which method they will use to calculate an arms-length price.

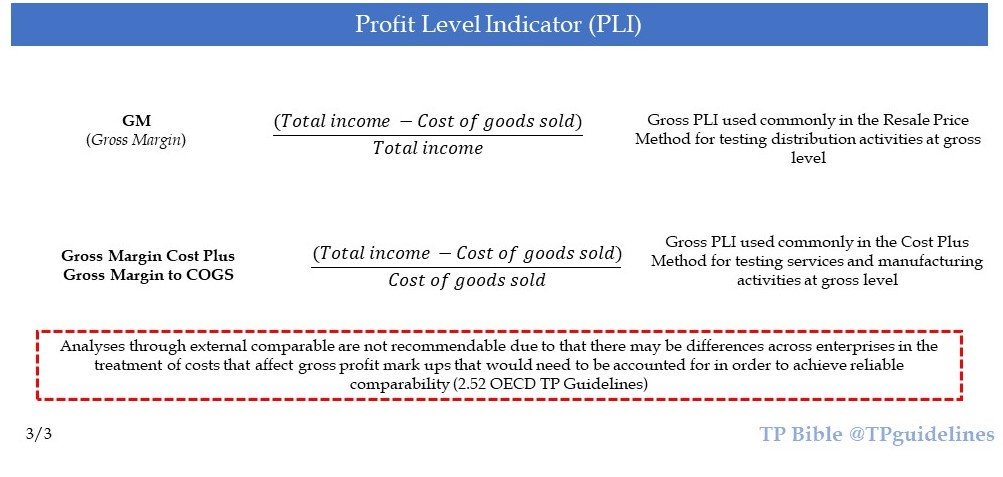

Commissioner of the IRS Return on Assets. Rasio Tingkat Pengembalian Total Biaya Net Mark-up. Profit Level Indicator P LI and Methods Transfer Pricing Methods GPSales GMRPM GPCOPCPM OPSalesTNMM OPTC Berry Ratio GPOpex OPVAE Berry Ratio 1.

Net Margin Laba Bersih Usaha x 100 Penjualan. TPG2022 Chapter II Annex I paragraph 4. March 09 2021 by Ednaldo Silva.

Transactional Net Margin Method TNMM for Transfer Pricing. In taxation and accounting transfer pricing refers to the rules and methods for pricing transactions within and between enterprises under common ownership or control. Terkait analisis transfer pricing apabila perusahaan kami menggunakan metode TNMM maka Profit Level Indicator PLI apa yang paling sesuai untuk digunakan.

Notwithstanding its acceptance in Coca Cola Co. The Transactional Net Profit Method TNMM uses a profit level indicator PLI as the object of the comparison. They must also decide which profit level.

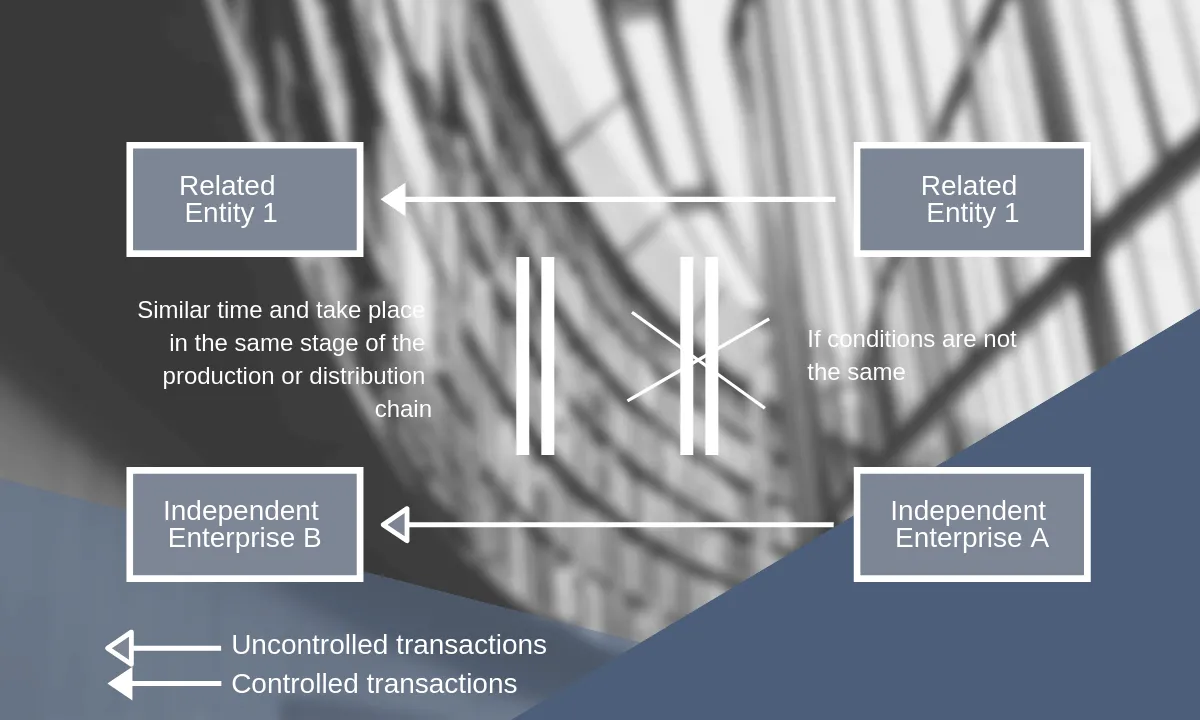

Transfer pricing methods are ways of calculating the profit margin of transactions or an entire enterprise or of calculating a transfer price that qualifies as being at arms length. January 20 2022 Net Profit IndicatorProfit Level Indicator PLI OECD Transfer Pricing Guidelines 2022 TPG2022. July 1 2017 Berry Ratio Intermediary activities OECD Transfer Pricing Guidelines 2017 Profit Level Indicator PLI Transactional net margin method TNMM.

A new transfer pricing perspective ratio analysis techniques. - Return on assets - Return on capital employed - Return on sales - Returns on total costs -. Net Margin dihitung dengan formula sebagai berikut.

A profit level indicator PLI is a measure. Operating activities are relevant for transfer pricing purposes. Companies can choose from a range of profit- level indicators for transfer pricing analyses.

In transfer pricing we use ratios to interpret. Chapter 5 - Transfer Pricing Methods Transactional Profit Methods. Profit Level Indicators PLI in Benchmarking Report under Transfer Pricing Regulations.

Transfer Pricing Methods

The Five Transfer Pricing Methods Explained With Examples

The Transactional Net Margin Method Explained With Example

The Five Transfer Pricing Methods Explained With Examples

The Transactional Net Margin Method Explained With Example

Transfer Pricing Methods Royaltyrange

Transfer Pricing Methods Crowe Peak

The Five Transfer Pricing Methods Explained With Examples

Tp Bible Twitter પર 2 Of The Most Commonly Used Profit Level Indicator Pli As Mentioned In 3 20 Transferpricingguidelines The Image Shows The Formula As Well As Different Common Denomination Any Other

Transfer Pricing Methods Crowe Peak

Transfer Pricing Methods Crowe Peak

Transfer Pricing Methods Royaltyrange

Centre For Tax Policy And Administration 13 Th Sgatar Working Level Meeting Transfer Pricing Macau 5 8 September Revision Of The Oecd Transfer Ppt Download

The Five Transfer Pricing Methods Explained With Examples

2

Transfer Pricing Methods Royaltyrange

Tp Bible On Twitter Gross Profit Level Indicator Pli Commonly Used When Applying The Resale Price Method Rpm And The Cost Plus Method Cpm Gm Gm Cogs Transferpricing Transferpricingguidelines Https T Co A2c2yowcdn Twitter